Many companies and organisations would really like to get started with blockchain projects, either to gain know-how or to expand their business. But two factors are blockers right now. First, there is a need for experiments to gain insights into how an existing business – for example an art gallery – could actually benefit. Secondly, there is a severe scarcity of blockchain developers. The lack of resources keeps many from early experiments and real innovation work.

A feature-rich platform to get started

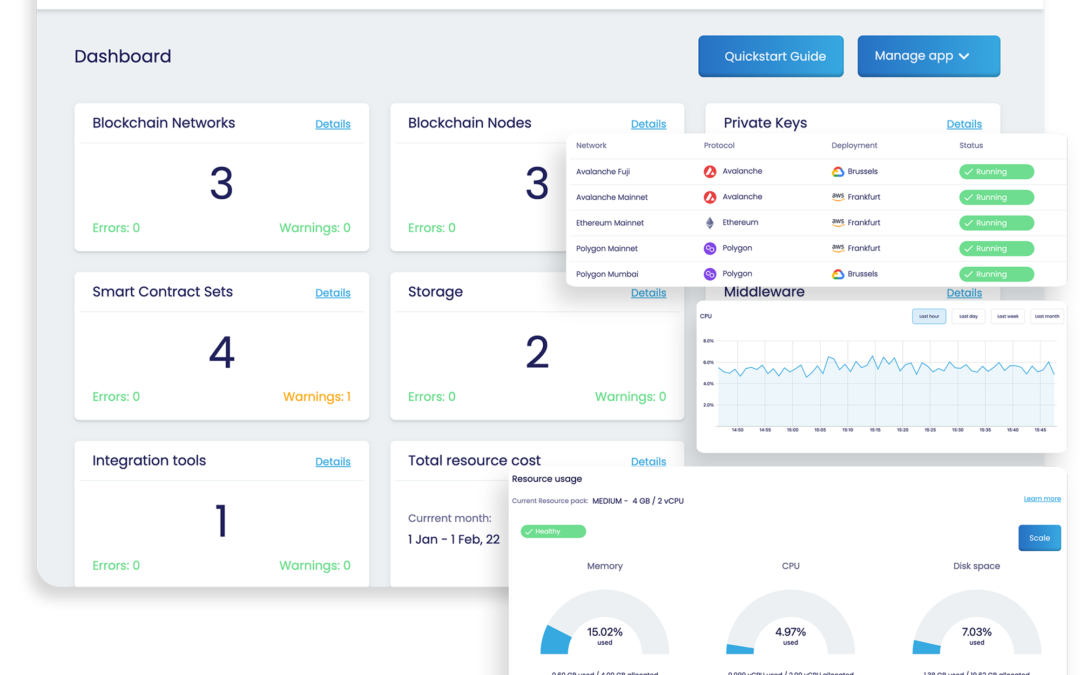

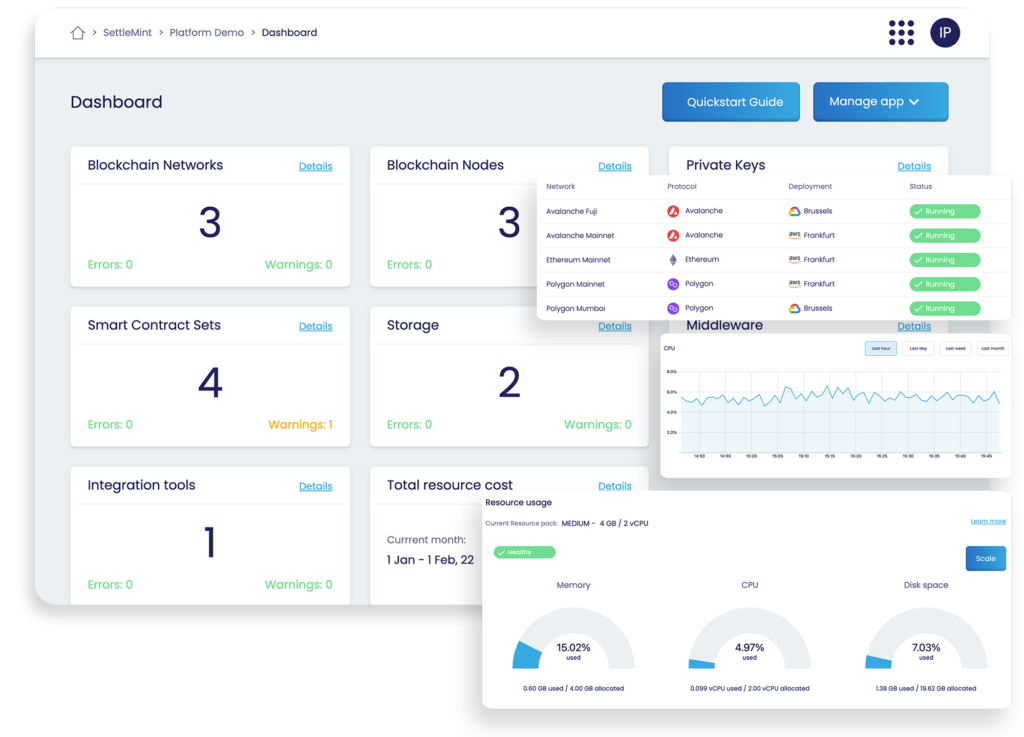

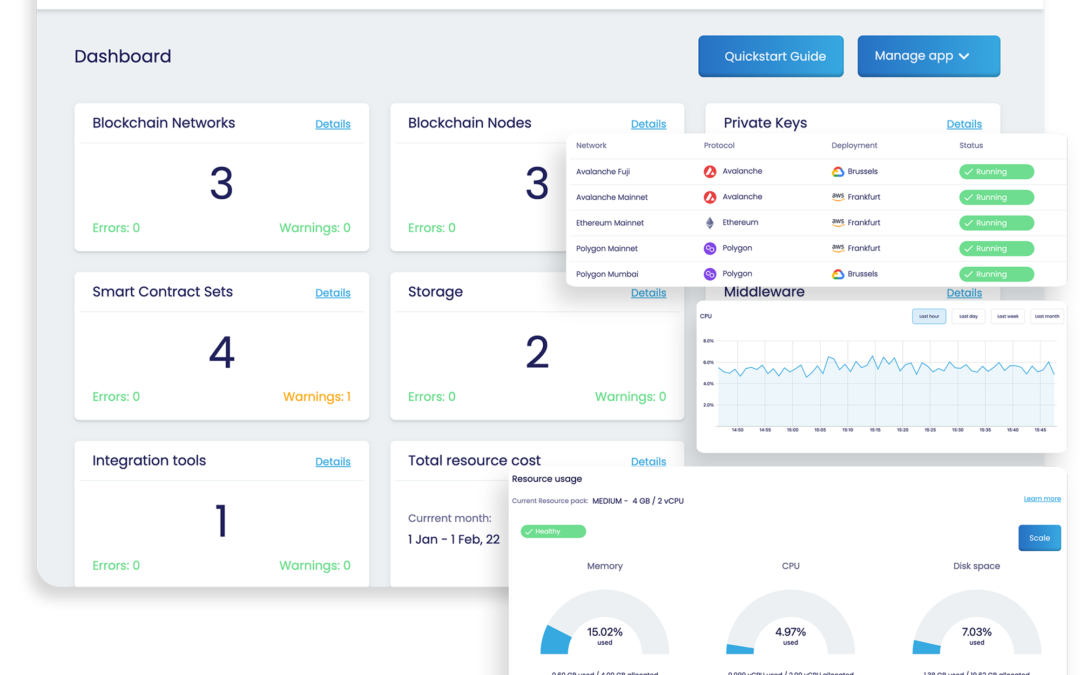

Settlemint, a company from Belgium, wants to change this. They have created a low code platform that promises to provide a fast way to “build, launch, integrate and monitor blockchain implementations with a low-code environment”.

The platform Settlemint has developed offers support for multiple cloud services (Google, AWS and Azure) and allows for the selection of a suitable blockchain protocol. Users can choose between Enterprise Ethereum, Ethereum, Hyperledger Fabric, Avalanche, Binance Smart Chain, Tezos and Polygon. According to the founders, almost 95% of all current use cases can be started with one of these protocols. With this background, even projects in an early stage will find the right chain, based on the needs and demands of a particular project.

The core: Adapting smart contract to a business logic

In many projects, it is the option to include smart contracts for certain workflows which is the new element of doing business. Here Settlemint can support a quick start through a number of pre-built smart contract templates, which can be adapted, based on the business logic of the client. All of the templates can be accessed at the code level so that developers can change and adapt based on a particular client’s needs.

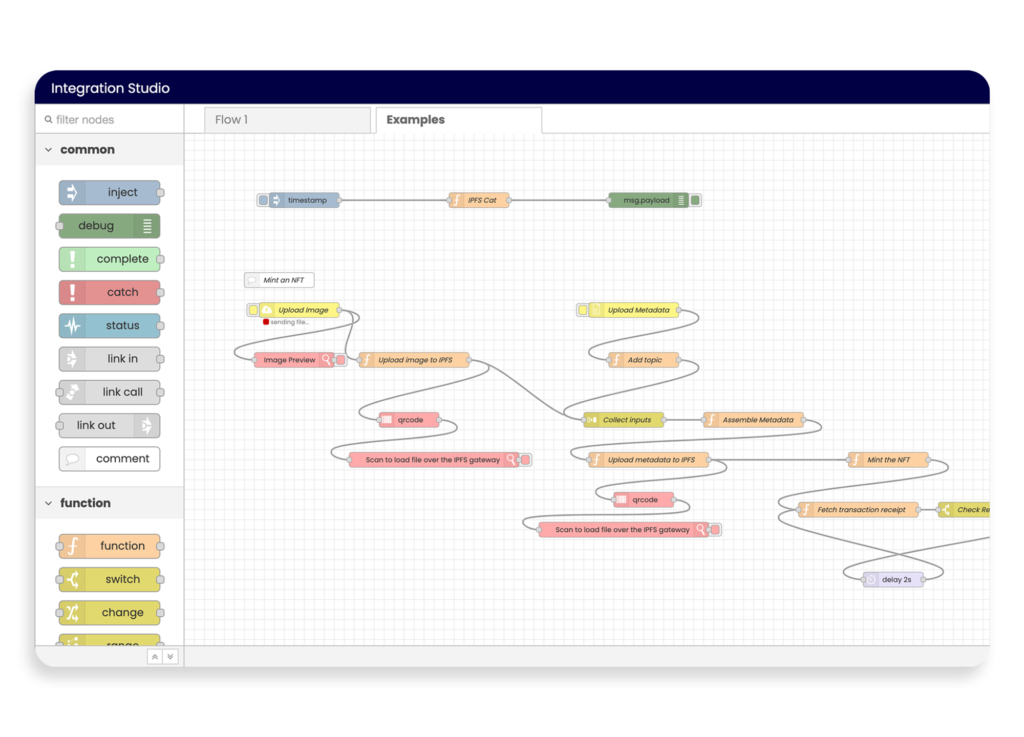

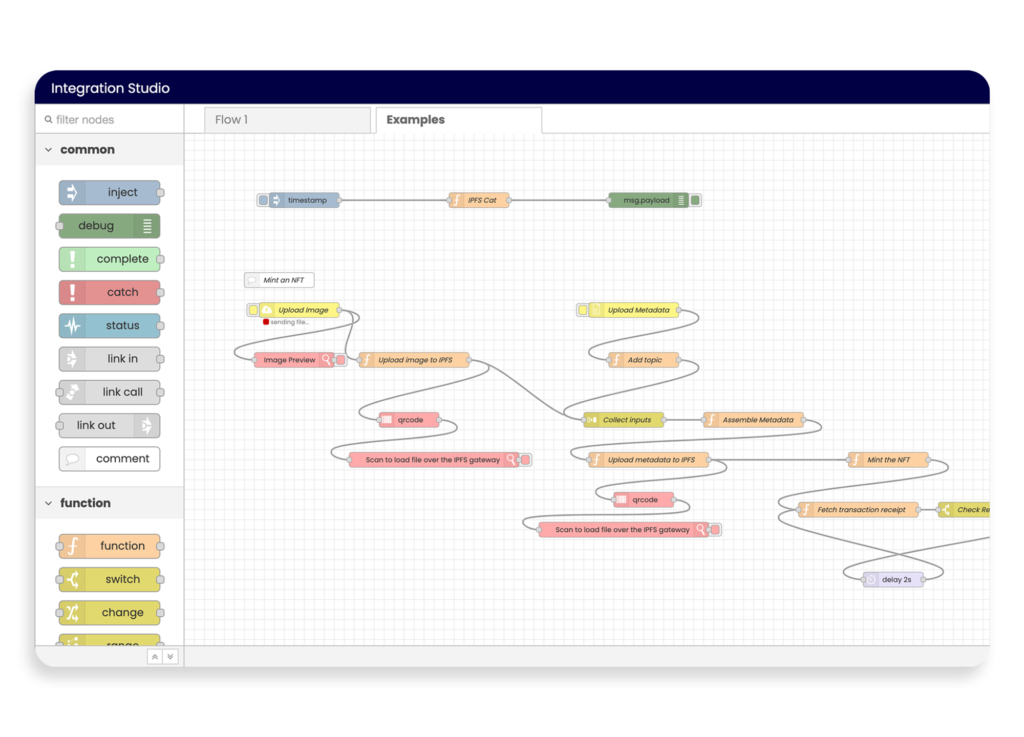

Instead of having to self-develop clients can use a visual dashboard to drag and drop applications together, based on a library of prebuilt integration modules.

Integration Studio. Source: Settlemint.

Additional services are a special backend solution to generate GraphQL APIs for data to be used in a given project. There is a Graph Middleware to connect applications. Finally, a monitoring tool enables the analysis of test runs, or to check on deployments for extensions and maintenance..

Like Lego for blockchain

“Settlemint was basically like Lego for us”, is what one client said about the experience with the platform. Settlemint was founded in 2016 and currently has a team of currently 45 people working. So far the company has already completed more than 50 Enterprise blockchain implementations. “We strongly believe that blockchain is the technology that will change our society, revolutionize our global economy and disrupt our industry”, says Matthew Van Niekerk, a founder & the CEO of SettleMint.

The focus of projects includes set-ups for NFT platforms or solutions for certain industries, such as banking, insurance, supply-chain management, food and beverage and logistics as well as use cases in energy or healthcare.

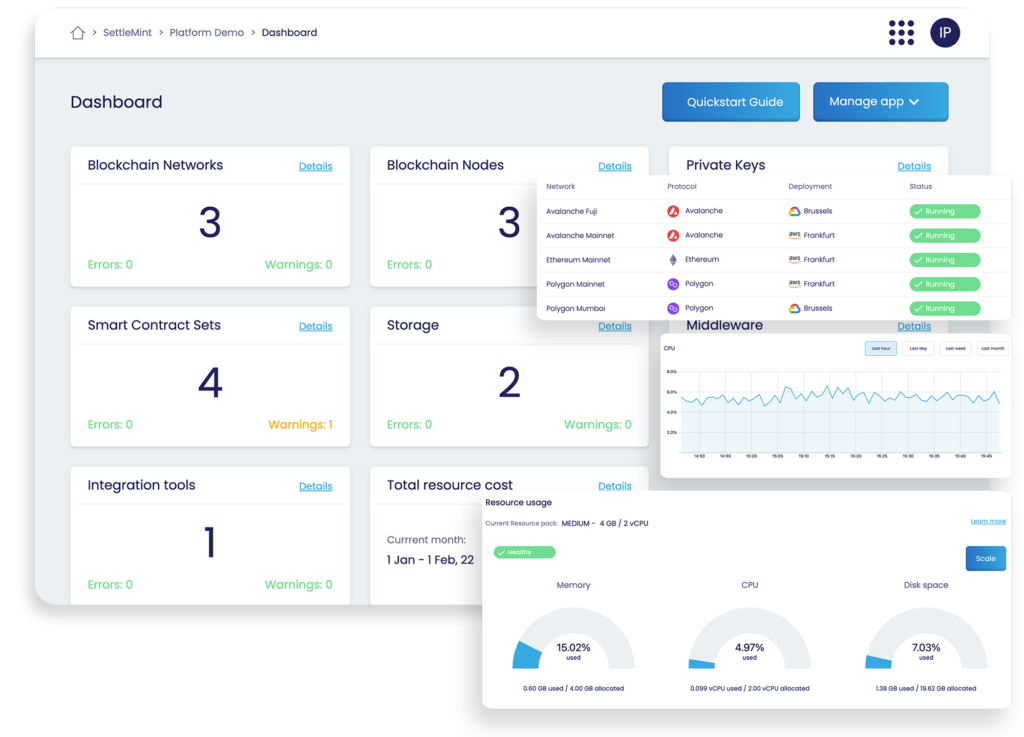

Monitoring Dashboard. Source: Settlemint

A sign of maturity is that on the homepage Settlemint offers a very simple way to calculate monthly prices for a given blockchain/cloud project – potentially clients can calculate themselves or get assistance from specialists. The question “How much does it cost?” seems to be a very frequent inquiry, with the calculator one can define a range. All resources are scalable, they can be extended with usage over time.

More information

For companies interested in trying out Settlemint, there is a 25-minute demo video where the CEO provides a walk-through of how the platform works. The demo is comprehensive and shows the platform in action – it really is quite simple to get started. Single users or teams can register for a free trial test of the low code platform on www.settlemint.com.

Below is an abstract of a scientific article, which has been accepted for publication by a prestigious journal. The findings are related and useful for the funded project of the team. Their project in TruBlo is called FogBlock4Trust. Findings from the work below are used in the project.

Authors:

Hamza Baniata, Ahmad Anaqreh, Attila Kertesz

Article:

DONS: Dynamic Optimized Neighbor Selection for Smart Blockchain Networks”, Future Generation Computer Systems

Main points:

- We propose DONS for enhancing Blockchain networks in terms of Finality and Fidelity.

- We propose AnoLE, a privacy-aware method for leader election in public Blockchains.

- DONS showed optimum message propagation in different network models and sizes.

- Our methods provide high security and privacy measures compared to current methods.

Abstract:

Blockchain (BC) systems mainly depend on the consistent state of the Distributed Ledger (DL) at different logical and physical places of the network. The majority of network nodes need to be enforced to use one or both of the following approaches to remain consistent:

- (i) to wait for certain delays (i.e. by requesting a hard puzzle solution as in PoW and PoUW, or to wait for random delays as in PoET, etc.)

- (ii) to propagate shared data through the shortest possible paths within the network.

The first approach may cause higher energy consumption and/or lower throughput rates if not optimized, and in many cases, these features are conventionally fixed. Therefore, it is preferred to enhance the second approach with some optimization.

Previous works for this approach have the following drawbacks: they may violate the identity privacy of miners, only locally optimize the Neighbor Selection method (NS), do not consider the dynamicity of the network, or require the nodes to know the precise size of the network at all times.

In this paper, we address these issues by proposing a Dynamic and Optimized NS protocol called DONS, using a novel privacy-aware leader election within the public BC called AnoLE, where the leader anonymously solves the “The Minimum Spanning Tree” problem (MST) of the network in polynomial time.

Consequently, miners are informed about the optimum NS according to the current state of network topology. We analytically evaluate the complexity, security and privacy of the proposed protocols against state-of-the-art MST solutions for DLs and well-known attacks. Additionally, we experimentally show that the proposed protocols outperform state-of-the-art NS solutions for public BCs. Our evaluation shows that the proposed DONS and AnoLE protocols are secure, private, and they acutely outperform all current NS solutions in terms of block finality and fidelity.

Fig. 1. Phases and steps of the proposed DONS protocol. Each step is performed by one (or more) system entity(s).

A step may depend on the result of a preceding step of the current round, or on the result of a subsequent step of the previous round.

Full paper:

DONS: Dynamic Optimized Neighbor Selection for Smart Blockchain Networks”, Future Generation Computer Systems, Volume 130, May 2022, Pages 75-90 https://doi.org/10.1016/j.future.2021.12.010

Creative Commons Attribution-NonCommercial-No Derivatives License (CC BY NC ND).

How newsrooms fight disinformation

Q&A with Julia Bayer and Ruben Bouwmeester, DW Research and Cooperation projects

Tuesday, December 14 • 12:00-13:00 CET • via Zoom

How do journalists work against mis- and disinformation? What are the workflows for the verification of content? What are the main challenges for newsrooms? And: What do the experts expect from future blockchain solutions? To get answers and insights please join us for an open webinar on December 14, 2021, from 12:00 – 13:00.

Join us as a guest

The event is organised for the now 25 funded project teams of TruBlo. But participation is open for guests from the NGI community, EU researchers, startups and developers. If you want to join as a guest please contact us at support@trublo.eu and we sent you the log-in credentials for the Zoom conference.

The experts will give a very brief overview, the session will then allow for Q&A by the participants.

What we discuss:

- How do journalists cope with disinformation?

- What are the workflows?

- Is there a way to overcome the current crisis of trust?

- What tools are available and working?

- What are current views on blockchain technology used for trustable content?

As part of the talk, the experts will talk about tools created to fight disinformation and to help with verification. Examples are the InVid verification plug-in, work done in the EU research project Digger (Deepfake detection) and Truly Media. The latter is a software platform for collaborative verification. Truly Media is used by a number of organisations, e.g. Amnesty International, Reuters, ZDF and the European Parliament.

Link: https://www.truly.media

Our experts:

Julia Bayer is an investigative journalist who dives deep online using OSINT. She has gained first-hand experience from work in the social media team of Deutsche Welle. In addition, she works as an innovation manager of the Research- and Cooperation team of Deutsche Welle. Julia is involved in a number of verification projects, such as the implementation of Truly Media and InVid. She also trains journalists in OSINT techniques and digital verification. Julia has worked with journalists in multiple international locations and has worked with newsrooms, NGOs and DW academy. Julia is the founder of @quiztime on Twitter, where a worldwide community of participants regularly has to solve verification and geolocation tasks.

Julia Bayer is an investigative journalist who dives deep online using OSINT. She has gained first-hand experience from work in the social media team of Deutsche Welle. In addition, she works as an innovation manager of the Research- and Cooperation team of Deutsche Welle. Julia is involved in a number of verification projects, such as the implementation of Truly Media and InVid. She also trains journalists in OSINT techniques and digital verification. Julia has worked with journalists in multiple international locations and has worked with newsrooms, NGOs and DW academy. Julia is the founder of @quiztime on Twitter, where a worldwide community of participants regularly has to solve verification and geolocation tasks.

Twitter: @bayer_julia

Ruben Bouwmeester brings concept development skills and profound graphical expertise. In his role as an innovation manager, Ruben was a key contributor to several software solutions and platforms used for the detection of disinformation and deep fakes. Ruben has been a key architect and manager for Truly Media, a collaboration platform created by the DW ReCo team in collaboration with Athens Technology Center. He has a background in project management, concept development, and design, holding a B.A. from The Hague University. As a ReCo innovation manager, Ruben specialises in User Generated Content (UGC), verification, and HLT. He also trained journalists at DW Akademie.

Ruben Bouwmeester brings concept development skills and profound graphical expertise. In his role as an innovation manager, Ruben was a key contributor to several software solutions and platforms used for the detection of disinformation and deep fakes. Ruben has been a key architect and manager for Truly Media, a collaboration platform created by the DW ReCo team in collaboration with Athens Technology Center. He has a background in project management, concept development, and design, holding a B.A. from The Hague University. As a ReCo innovation manager, Ruben specialises in User Generated Content (UGC), verification, and HLT. He also trained journalists at DW Akademie.

Twitter: @rubybouw

Average reading time: 12 min (2494 words)

Photo by Visual Stories || Micheile on Unsplash

You heard about Bitcoin, Ethereum, maybe Dogecoin. But are you familiar with Litecoin, Cardano or Polkadot? Because there are so many different coins, the entire field of cryptocurrency is quite confusing. As of November 2021, a total of 7,000 crypto coins exist. If you want, go to Coinmarketcap, the website keeps track of them.

Why so many? Do they all need a lot of energy, like Bitcoin? Who creates them? Who might be using them? And: Why are some coins rising in value? Why are others worth nothing?

Essential points covered in this article:

First, we define what a crypto coin is. Then we talk briefly about technological basics like an overview of coin creation.

Secondly, we look briefly introduce some coins to show different features. On our list are Bitcoin, Ethereum, Cardano, Polkadot, Bitcoin Cash, Stellar, Binance Coin and finally, two “meme coins” called Dogecoin and Shiba Inu.

First, the basics:

What is a cryptocurrency, a crypto coin or a token?

A cryptocurrency is a form of digital money. One unit is described as a “token” or a “coin”. In this article, we will stick to the word “coin” for simplicity. It is possible to exchange a coin for services or goods. Every coin has a value. Most coins, even Bitcoin and Ethereum, started with very low values. The information about transactions with the coins is kept on a blockchain. A good comparison of a blockchain is the ledger of a bank account. The information is encrypted, the data is decentralised. There is no single authority.

Why do you need a coin? A simplified example: You may want to buy an item in a game. The game only accepts a particular coin. You would then have to either earn this particular currency or change real money into such coins. The process of making coins is often called mining.

What is a protocol?

Every cryptocurrency is based on software. For every coin, there is a protocol. The protocol is the underlying software, and it defines the rules for the blockchain and the coins. For example: How to add a new coin or what the value is. Further, the protocol can define how many coins can be created and the creation mechanism. Here is an initial, partial answer to why there are so many coins: Every protocol has different rules, every protocol can have a new coin. The features of a protocol are an essential factor in whether it will become popular and used by developers.

But besides these fundamentals, there are some universal reasons for the boom in crypto coins since 2013: These are (a) speculation, (b) ICOS or Initial Coin Offerings and (c) innovation.

Speculation: Bitcoin and Ether were worth almost nothing for several years. But since 2017, the value of both has risen, creating several thousand millionaires and even billionaires among early adopters. As of 2021, many new users are drawn into crypto because coins promise to rise in value over time. There is huge volatility, though. And the whole development might result in the boom-and-bust cycle in the next few years.

ICOs: The word ICO is short for “Initial Coin Offering”. Between 2013 and 2018, there was a boom of blockchain projects with a specific pattern: For example, one project would propose to create a new social network, such as a decentralised competitor to Facebook. To start such a software platform, they needed funding, of course. In an ICO, a project would offer “coins” to people who would buy them just like investors in a more common IPO (Initial Public Offering). While you would have to grow a company for many years to be ready for an IPO, an ICO is similar, but at the very start of a project. Many such ICOs collected money this way, but they did not reach their goals in terms of software development. Often early investors lost their stakes. The ICO boom lasted for about two years, from 2016 to 2018, followed by a bust. But during this period, a lot of people learned how to do this.

Innovation: Innovation is a significant driver. Blockchain is still a new technology. Many people in this field hope for a better world through decentralised finance. When Tim Berners-Lee invented the web, it offered the new option to link one bit of information to another. A future blockchain-enabled web might have “links” that are even more powerful, which can be verified and used for all kinds of transactions instantly and at low costs.

In the final part of this article, we detail some popular coins and how they are different:

Bitcoin

Bitcoin was invented as a way for people to send a payment across a network, securely and semi-anonymous, without interference or control of a central authority. Bitcoin is the oldest and best-known cryptocurrency and the biggest by market value.

“Bitcoin is a digital currency which operates free of any central control or the oversight of banks or governments. Instead, it relies on peer-to-peer software and cryptography. A public ledger records all bitcoin transactions and copies are held on servers around the world.” (New Scientist)

Bitcoin started in 2009. From the start, the total supply was limited to 21 million coins. So far, about 18 million are already mined. But not all of those are used because a certain amount of Bitcoins is considered lost. The owners have forgotten about them or have no access anymore because they lost the passwords to open them.

Because of the limited number of coins, Bitcoin is labelled as “digital gold”. There is a speculative expectation that demand will keep the value stable. After a slow start, it started to rise. Since 2009 the value of one bitcoin has risen from barely above zero to over $65,000. https://www.coindesk.com/price/bitcoin/.

There is no real-world value backing Bitcoin or the other cryptocurrencies real-world value. A government does not back them. Instead, the value is determined mainly by supply and demand. Regularly some experts warn about a financial bubble caused by the current speculation in these coins. On the other side, many common currencies are not backed by real value, too – it is a matter of trust that we all agree that one Dollar or one Euro is worth a certain amount of goods or services.

The process of finding new coins is called mining. A miner must find a specific number to do that. Getting the number means having to use high-performance computers. If the solution is found and verified, the miner can add a new Bitcoin to the chain. This process is called Proof-of-Work (PoW). Miners get paid for their work. For Bitcoin, the process of mining automatically becomes harder. One effect of this is the rising use of energy by miners. The University of Oxford tracks the energy consumption of Bitcoin and has a global mining map.

Ether (ETH)

Ether is the coin used by Ethereum and is considered a Bitcoin alternative. The creators introduced the option to create “smart contracts”. This one feature is the main reason why Ethereum is very popular. Not all, but many decentralised finance projects use Ethereum.

A “smart contract” is simply a piece of code that is running on Ethereum. It’s called a “contract” because code that runs on Ethereum can control valuable things like ETH or other digital assets. A smart contract will define specific rules. If the rules are fulfilled, the “contract” will execute automatically. This way, all participants can be sure that a given transaction will be completed, even if the participants do not know each other or cannot trust each other.

Ether is the second most popular cryptocurrency, but total market capitalisation is less than Bitcoin. Trust is created through the blockchain and the smart contract; the participants trust the network, even if they do not trust the other party in exchange. Like Bitcoin, a new Ether coin is mined. https://ethereum.org/en/developers/docs/consensus-mechanisms/pow/mining/ To reduce the energy needed to create a new block, Ethereum has been working on an update to the software, which will change the approach to mining. The principle will change from Proof-of-Work (the process used by Bitcoin) to Proof-of-Stake (which strongly reduces the energy needs).

Litecoin (LTC)

Litecoin was launched in 2011 by a former Google engineer. Litecoin is in some ways comparable to Bitcoin. Some people describe it as the “silver to Bitcoin’s gold”. Key differences are: It is easier and faster to generate a new block in comparison to Bitcoin. On the Litecoin homepage, the approach is positioned as “the cryptocurrency for payments”. https://litecoin.org

So here is another partial answer as to why there are so many crypto coins: Firstly, it is not overly difficult to create a new one. Secondly, the creators might have a good reason to do so. Litecoin, as the name implies, aims to simplify things that are more complex with older coins. The value of any crypto coin depends on two main factors: Whether developers are using them in their applications and whether any merchants are accepting them as payment. As of November 2021, Litecoin has a market capitalisation of $14 billion and a per-coin value of $200. https://litecoin.org

Cardano (ADA)

This alternative coin was started by a co-founder of Ethereum, who left the former project because of different views on how the technology should evolve into the future. Today the project is further developed by a group of scientists and developers. Members of the group have published multiple scientific articles to secure users’ trust and make the right decisions on how to structure Cardano.

Cardano uses a so-called “Ouroboros proof-of-stake”. (Yes, all these words and concepts are not easy to understand. ) Ouroboros is the name of a family of consensus protocols, enabling the creation of permissioned and permissionless blockchains. The Cardano project states: “A proof-of-stake protocol that provides and improves the security guarantees of proof-of-work at a fraction of the energy cost. Ouroboros applies cryptography, combinatorics, and mathematical game theory to guarantee the protocol’s integrity, longevity, and performance and that of the distributed networks that depend upon it.

Recently an article on Motley Fool labelled Cardano as a potential “Ethereum killer”, based on the assumption that the research-based approach will lead to long-term benefits over Ethereum. Cardano is currently preparing to launch smart contract features on the platform. Website of Cardano

Polkadot (DOT)

Polkadot has a great (easy to remember) name. It is a protocol designed to enable interoperability between different blockchains. Differences between blockchains can be whether the process is permissioned or permission-less. Because there are differences, Polkadot can act as a translator.

A second reason to use Polkadot is the concept of “shared security”. New blockchains are, in general, more accessible to attack than older, larger chains. The larger a chain gets, the more complex it would be to “overtake” it and forge transactions. Here Polkadot helps new projects by allowing them to start while “sharing” the security of the older network. Like with Cardano, the creator of Polkadot was an early member of the Ethereum team. The Polkadot project homepage is here.

Bitcoin Cash (BCH)

We already saw that the early team members of Ethereum left that project to start with new approaches. Something similar happened between Bitcoin and Bitcoin Cash. Because the whole concept is relatively new, debates on letting the underlying software evolve are common and valuable. If there is no agreement, there are two options: Start a new project. Or, as in the case of Bitcoin Cash, perform a “hard fork”. The old chainstays, a new chain starts. Bitcoin cash came into being this way in 2017, primarily based on some changes designed to make it more scalable. Bitcoin cash currently has a market capitalisation of $10,5 billion, considerably less than Bitcoin.

Stellar (XLM)

Stellar is a specialised blockchain designed for use by large banks. “Stellar is an open network for storing and moving money”, is the description on the project’s homepage. The main goal is to simplify huge transactions of (traditional) money and make them cheaper. The coin of the Stellar network is called Lumens. The software is specialised but can be used by everyone—more about Stellar.

Tether (USDT)

Tether is a stable coin. The market value is tied to a currency or another fixed reference point. By its definition is described like this: “Tether is a blockchain-enabled platform launched in 2014 to make it easier to use fiat currency digitally. Every USD-pegged TETHER token (USD₮) is pegged to the dollar one-to-one; therefore, 1 USD₮ is always valued at 1 USD by Tether.”

By “pegging” the price for one token to the value of a currency, people who are using or holding Tether do not experience sudden value changes due to speculation. These price changes happen with Bitcoin and Ethereum. Note that there are other Tether tokens connected to other currencies, such as the Euro. More about Tether here.

Binance Coin (BNB)

Binance is one of the largest cryptocurrency exchanges. Binance Coin is their self-created currency to let users pay for transaction fees. The BNB was based on Ethereum but has since gained independence by launching its blockchain and infrastructure. Read more about BNB here.

Meme coins

Finally, let us look at two coins which only recently have become popular. These two might be the most confusing. Meme coins are often pushed forward through social media. “They tend to be highly volatile compared to major cryptocurrencies like bitcoin (BTC) and ether (ETH). This is likely because meme coins are heavily community-driven tokens. Social media and online community sentiments usually influence their prices. This often brings a lot of hype but also FOMO (Fear of missing out) and financial risk. While it’s true that some traders became rich with meme coins, many lost money due to market volatility.” (Source: Binance Academy)

Dogecoin (Doge)

This coin was created as a joke; the two creators wanted to comment on the wild speculations of other coins on the market. Surprisingly though, Dogecoin itself became a subject of speculation and had a spectacular rise in value. But although the concept behind the coin is not as sophisticated as the others, it became widely known. The next step then was that more exchanges opened the option to buy and sell them. Similarly, real-world businesses started to accept Dogecoin as payment. Welcome to the wild west of current cryptocurrencies. More about Dogecoin.

Shiba Inu Coin (Shib)

Even more recently, the whole story was more or less repeated, with a coin called “Shiba Inu”, which to some extend was a copy of Dogecoin. By now, though, there is a particular pattern: Because a few thousand people got very rich being early owners of some coins, they can buy and sell vast quantities of such new coins. At times this triggers wild fluctuations. Shiba Inu managed to overtake Dogecoin in value, at least briefly, in 2021. Why and how it rose is worth reading about but would make this particular story too long.

Coins other than Bitcoin are often called “Altcoins” for “alternative”. But because some of the 7,000 coins in existence do not have a clear purpose or might be used just for speculation, they are sometimes labelled as “shitcoins“. But, specifically for the last two, a more negative term is in use because they are used for speculation and might result in significant losses for people investing in them.

Outlook

It is difficult to say which coin and which blockchain concept will ultimately become the standard. There is a lot of potential for innovation in blockchain and coins. At the same time, the speculation injects a considerable risk.

Julia Bayer is an investigative journalist who dives deep online using OSINT. She has gained first-hand experience from work in the social media team of Deutsche Welle. In addition, she works as an innovation manager of the Research- and Cooperation team of Deutsche Welle. Julia is involved in a number of verification projects, such as the implementation of Truly Media and InVid. She also trains journalists in OSINT techniques and digital verification. Julia has worked with journalists in multiple international locations and has worked with newsrooms, NGOs and DW academy.

Julia Bayer is an investigative journalist who dives deep online using OSINT. She has gained first-hand experience from work in the social media team of Deutsche Welle. In addition, she works as an innovation manager of the Research- and Cooperation team of Deutsche Welle. Julia is involved in a number of verification projects, such as the implementation of Truly Media and InVid. She also trains journalists in OSINT techniques and digital verification. Julia has worked with journalists in multiple international locations and has worked with newsrooms, NGOs and DW academy. Ruben Bouwmeester brings concept development skills and profound graphical expertise. In his role as an innovation manager, Ruben was a key contributor to several software solutions and platforms used for the detection of disinformation and deep fakes. Ruben has been a key architect and manager for

Ruben Bouwmeester brings concept development skills and profound graphical expertise. In his role as an innovation manager, Ruben was a key contributor to several software solutions and platforms used for the detection of disinformation and deep fakes. Ruben has been a key architect and manager for